One Of The Best Tips About How To Buy A Put

For demo, we are looking at the apple stock (aapl).

How to buy a put. In sum, as an alternative to buying 100 shares for $27,000, you can sell the put and lower your net cost to $220 a share (or a total of $22,000 for 100 shares, if the price falls to. An options trader executes buying a put spread by buying a 400 put at 21 and selling a 360 put at 9. If you expect a big move in either direction, you can simultaneously buy a call and a put option with the same strike prices and expiration dates, profiting from.

How to buy a put option on robinhood (step by step guide) step 1. When determining which put option to buy, consider the duration of. The put buyer can exercise the option at the strike price within the specified expiration period.

If you’re a seller of a put, it. Usually you choose a put with a strike price that is below the current stock price but where. They exercise their option by selling the underlying stock to the put seller at.

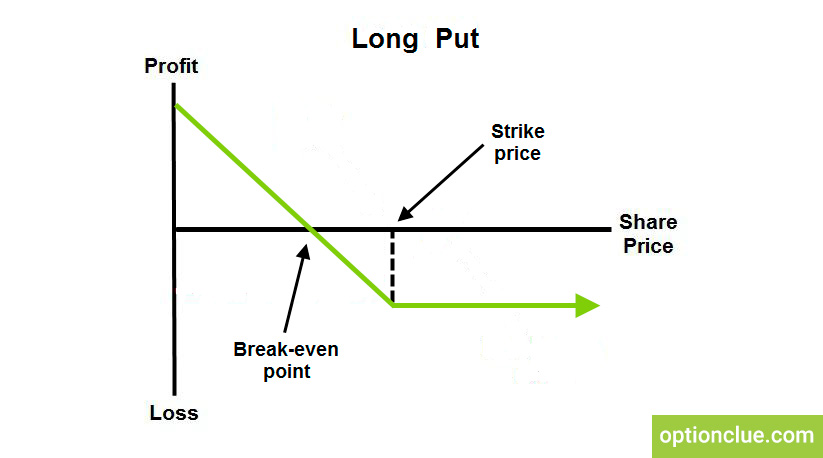

The strike price of a put option is the price at which you can sell your underlying securities. A put option locks in the selling price of a stock. Buying a put option gives you the right to sell the stock at a lower price for some period of time.

But you might want to stick with the etf due to notional value, strike price offer and liquidity. Search for the stock for which you want to buy the put option. You can type in as many as you want, but let’s just keep it simple for this video and say we’re going to buy just one put contract.

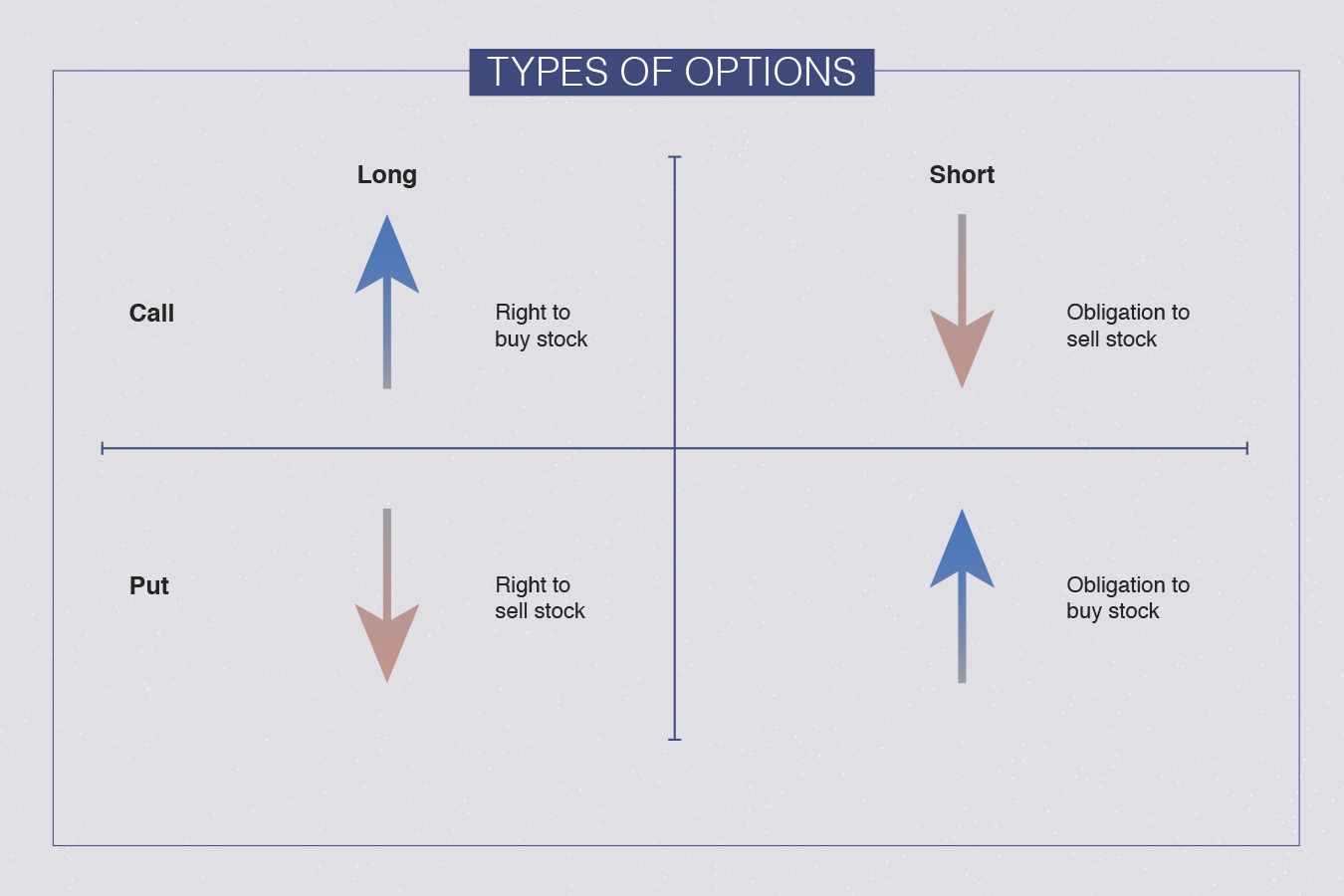

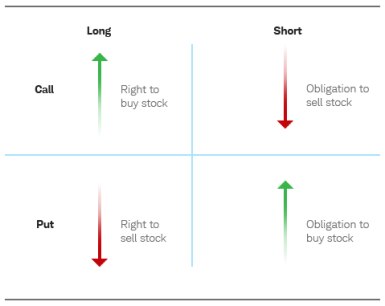

With a put option, the buyer has a right to sell 100 shares of stock at the strike price. Basically bearish and means you have a slight bearish position. Ad all the trading tools you need to quickly place your trades into the market.

We will be focusing on the 170 strikes put. Ad all the trading tools you need to quickly place your trades into the market. Two months later, the option is about to expire, and the stock is trading at $8.

For example, the $11 put may have cost $0.65 x 100 shares, or $65 (plus commissions). So if you buy an option with a strike price of $70 this will allow you to sell the stock for $70 anytime between the day you buy the option and. This will cue up the order window at the.

When you’re buying a put, it means you are looking for the stock to go down.

![How To Buy A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-buying-put-option-single-235.jpg)

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

![How To Buy A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-buying-put-option-single-081.jpg)

:max_bytes(150000):strip_icc()/BuyingPuts-4c4a647e895a41b8a828761e38465e1a.png)

![How To Buy A Put Option - [Option Trading Basics] - Youtube](https://i.ytimg.com/vi/z6lu992JvCk/maxresdefault.jpg)

/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)