Cool Info About How To Sell Puts And Calls

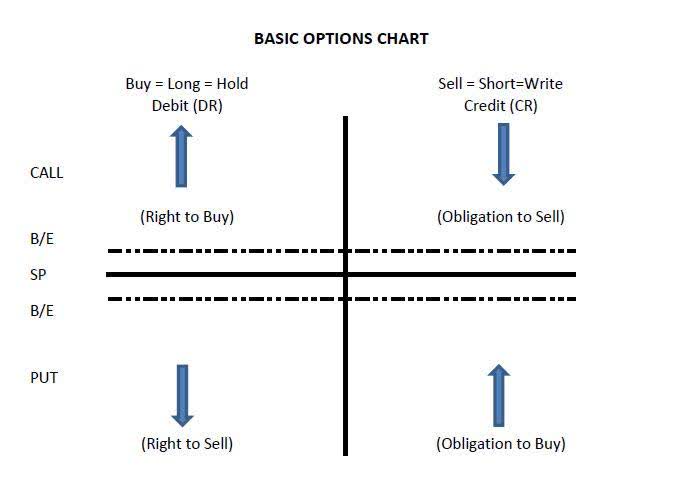

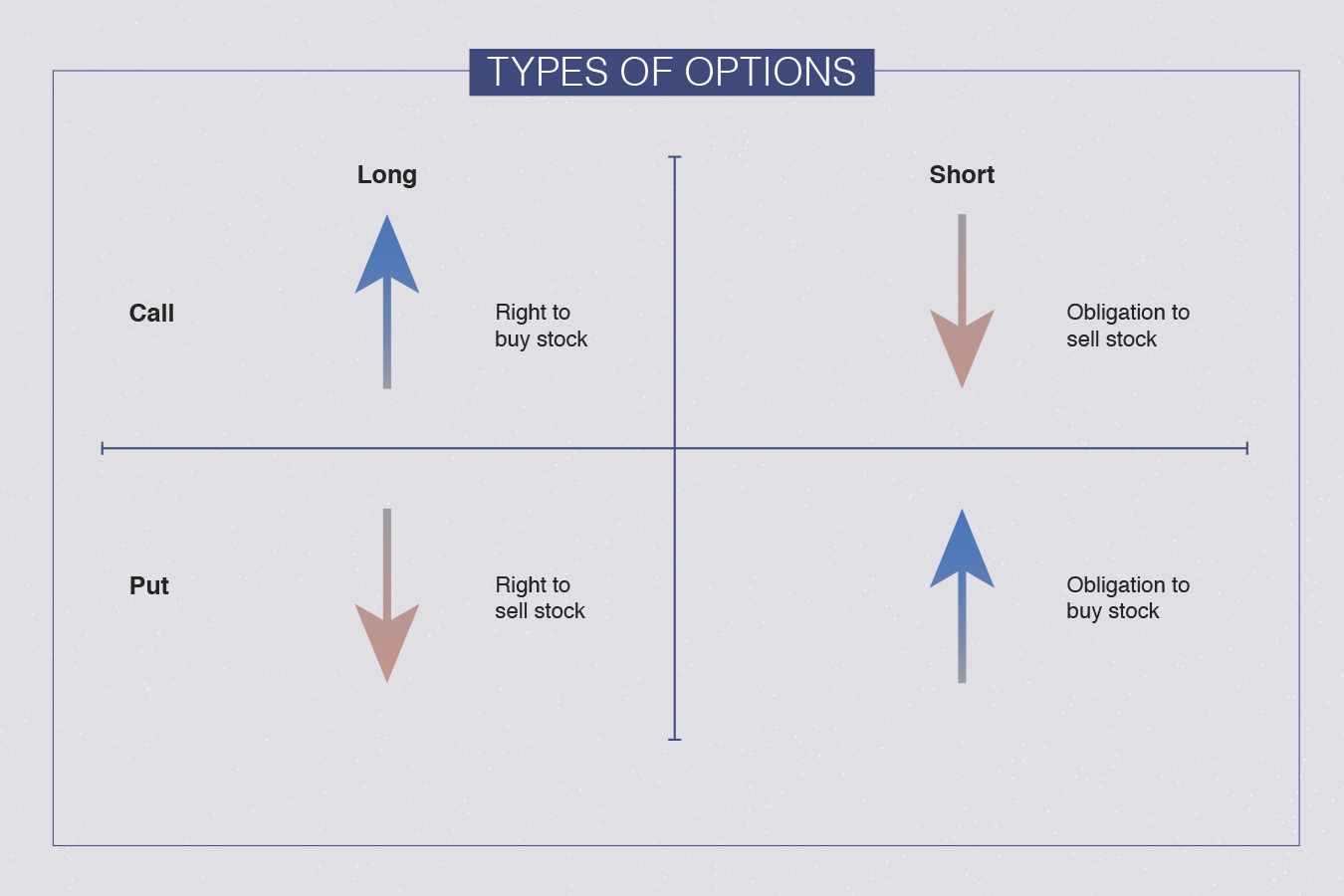

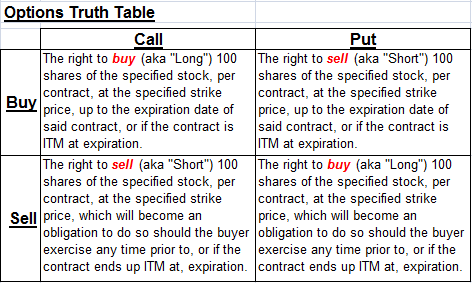

They are structured similarly with four contracts:

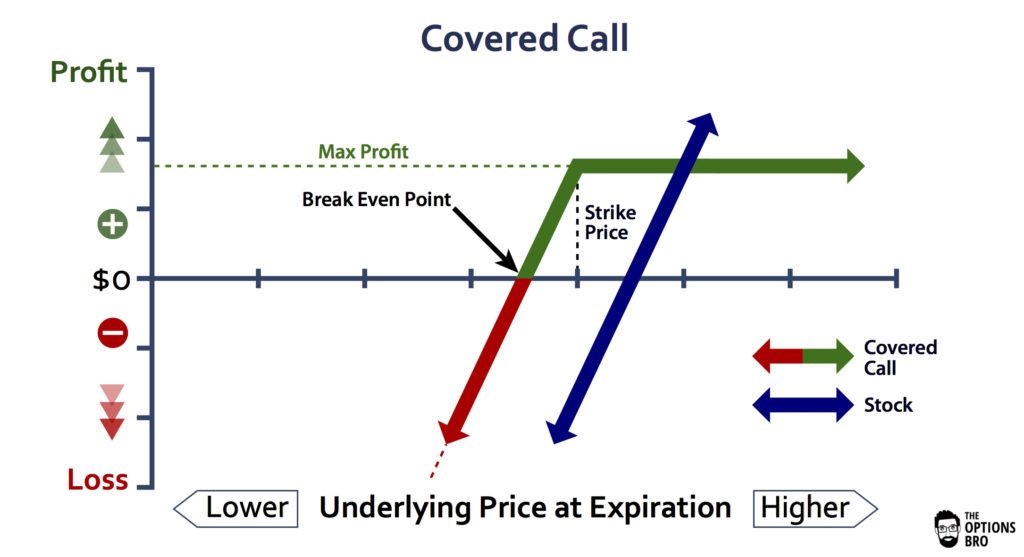

How to sell puts and calls. The strategy of selling uncovered puts, more commonly known as naked puts, involves selling puts on a security that is not being shorted at the same time. The difference with the iron butterfly is that both short contracts are sold at. Turn around and sell call options against our shares and continue to collect option premium and any dividends.

The seller of a naked put anticipates the underlying asse… see more First, it is essential to understand that there are two ways to sell a call option, by writing a new contract, or by selling a call option you already own. This is truly my favorite option trading strategy, selling naked puts and writing covered calls.

Sell the shares and be done with the position. The intent of selling puts is the same as that of selling calls; Instead of selling calls, you are selling puts.

Options that are farther out of the money will have lower premiums, but will also provide. The two main types of options are calls and puts.either can be bought or sold. The buyer of a call option is bullish and believes the underlying stock will rise in price before the.

Finally, decide which calls are the best to sell or which puts are the best ones to buy.

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy2_2-aab223af50cc44ba9a0f874609356225.png)

:max_bytes(150000):strip_icc()/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)