Stunning Info About How To Lower My Pmi

3 ways to get rid of your pmi if you don’t want to wait at least a few years until you reach the 20% equity threshold to have your pmi removed, you have three other options.

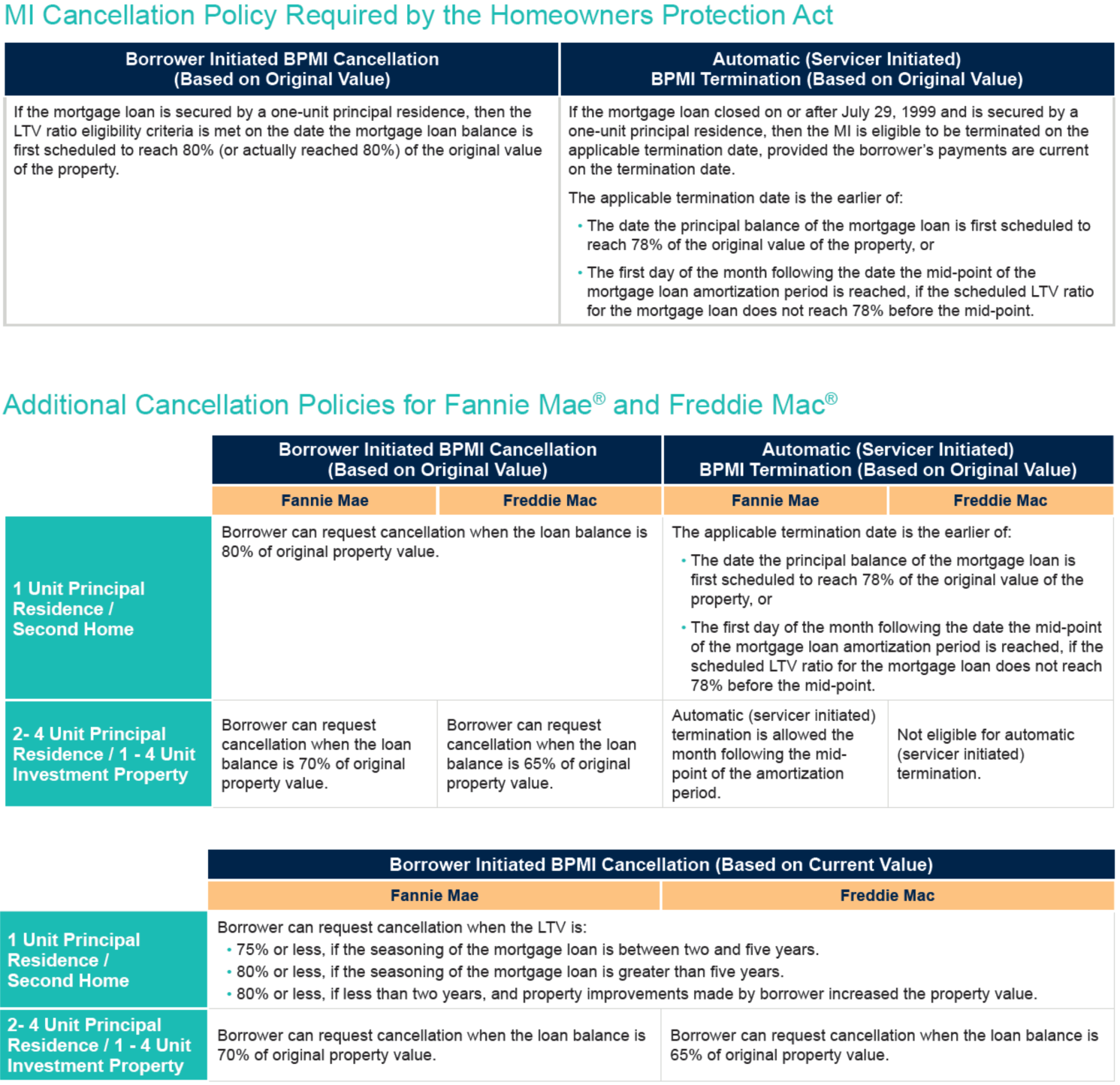

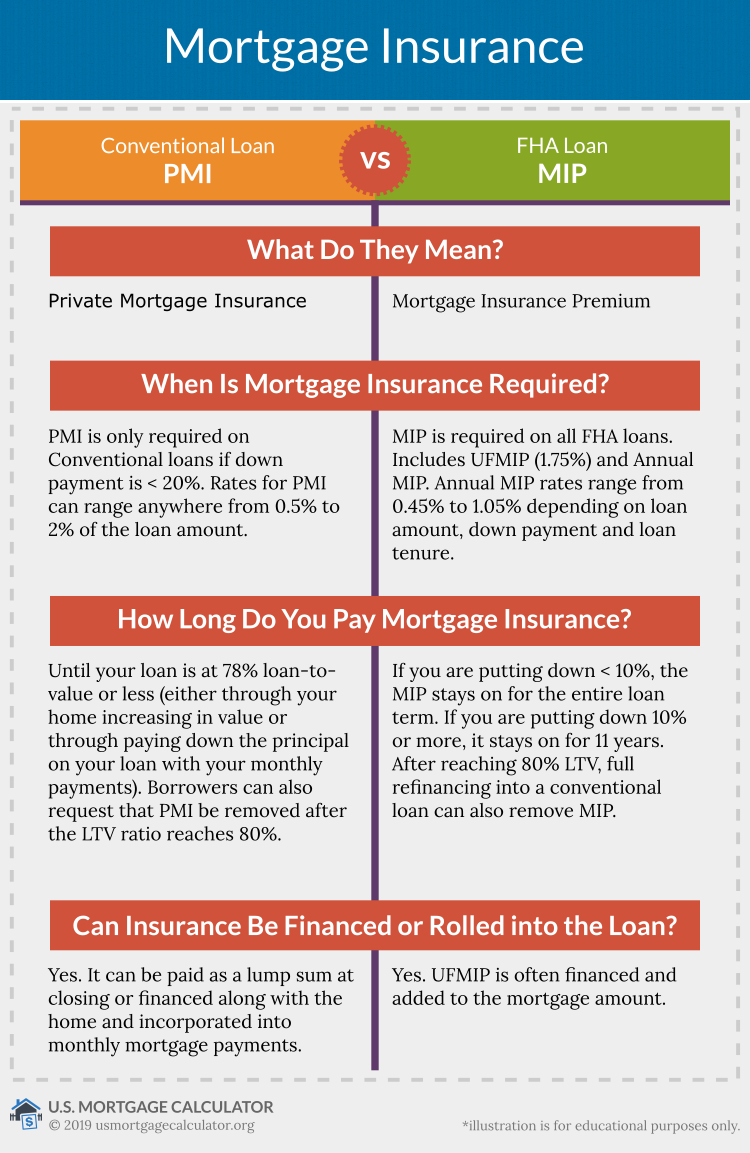

How to lower my pmi. To sum up, when it comes to pmi, if you have less than 20% of the sales price or value of a home to use as a down payment, you have two basic. (1) requesting pmi cancellation or (2) automatic or final pmi termination. This means you can afford to make a 20 percent down payment, and as a borrower, you wont have to pay.

The law generally provides two ways to remove pmi from your home loan: The good news is that pmi can usually be canceled after your home’s value has risen enough to give you 20% to 25% equity in your house. 4 ways to get rid of pmi 1.

Conventional loan the magic ltv ratio for most lenders is 80 percent. How do i lower my pmi? Make payments until pmi is canceled:

Try a first mortgage equal to 80 percent. Ways to lower pmi include using a larger down payment, splitting your loan, improving your credit score, refinancing your home and making extra payments. Ad if you owe less than $420,680, take advantage of a generous mortgage relief program & refi.

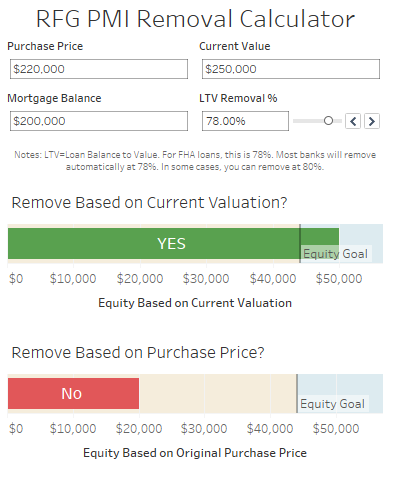

“pmi will drop off automatically once your ltv reaches 78%.” he adds that it. The good news is that you can request your lender remove pmi once your home equity reaches. To get rid of pmi on a conventional loan you can:

How can i get rid of pmi without 20 percent? Pay down your mortgage for automatic or final termination of pmi. Removing pmi, appealing your property tax assessment, and shopping around for better home insurance rates are other ways to potentially reduce your mortgage payment.

You may want to make biweekly. Here are several strategies to reduce or eliminate mortgage insurance costs. By law, mortgage lenders are.

When you have a conventional loan, getting rid of pmi is just a matter of waiting. Take advantage of the government gse's mortgage relief product before it's too late. Go piggyback instead of getting one mortgage, get two.

The federal homeowners protection act gives you the right to remove pmi. Your home equity needs to be at least 20% or you will probably need to pay for pmi. Building your credit score, paying down debt and putting down as much as you can afford may reduce your pmi costs.

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance3-371bab72617d42d28def5f93c622d6e5.png)

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)