Lessons I Learned From Info About How To Fix Ruined Credit

Continually monitor your credit regularly check your credit report even after your divorce is finalized.

How to fix ruined credit. Take some of the stress out of unplanned expenses, with aarp money map. If you owe more than half of your credit limit on any credit card, this will have a negative impact. Creditors can issue reports to any of the three bureaus, so you need reports from each bureau to have.

This will improve your credit as you show yourself able to make the payments on time. I suggest that you pay the landlord now. The bureau “contacts your bank and the bank refuses to.

You can’t just make up a commitment to changing your. Aside from putting yourself at risk of overspending, opening up too many credit cards at once is a red flag to lenders because it seems as if you're desperate for credit. Credit reports contain a history of your credit usage details dating back to 10 years.

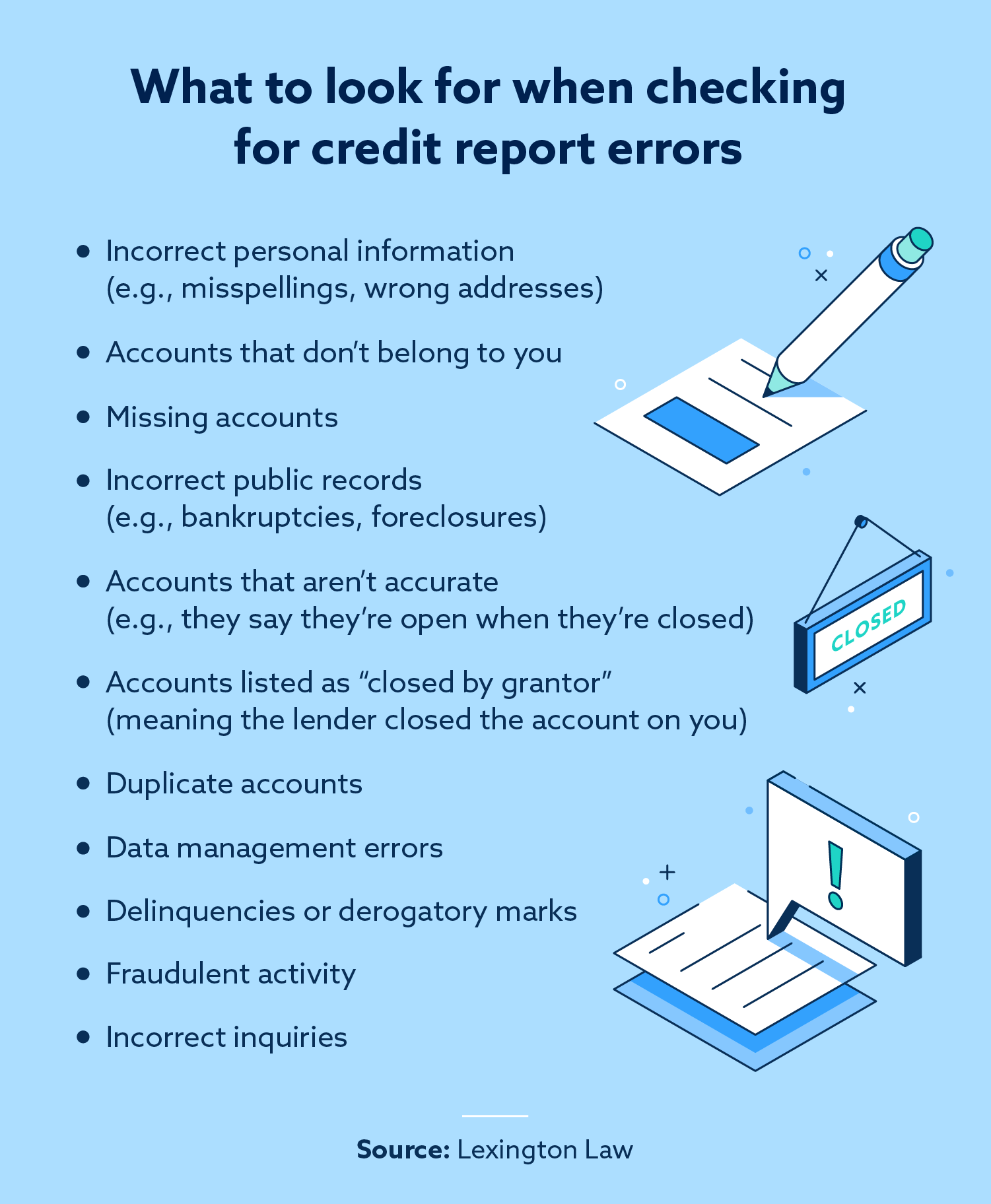

Make sure the credit reporting companies are notified that the debt has been paid. Step 1 contact each of the three credit bureaus to request your credit reports. Try an installment account to get a better credit score and make some money.

Every time you apply for a new credit card. Close revolving accounts that have been affected. Pay down the balance on any credit card that is 50% or more of the credit limit.

Find the right one for your unique needs. Monitor your credit score and reports. You have to be committed to making real changes to your spending habits.

Stop applying for more credit! Discover short videos related to how to fix ruined credit score on tiktok. Keep your credit card balances below 50 percent of your credit limit.

These loans are backed by the united states government. Then you can go after the roommate for the money. Fha loans offer lower down payments.

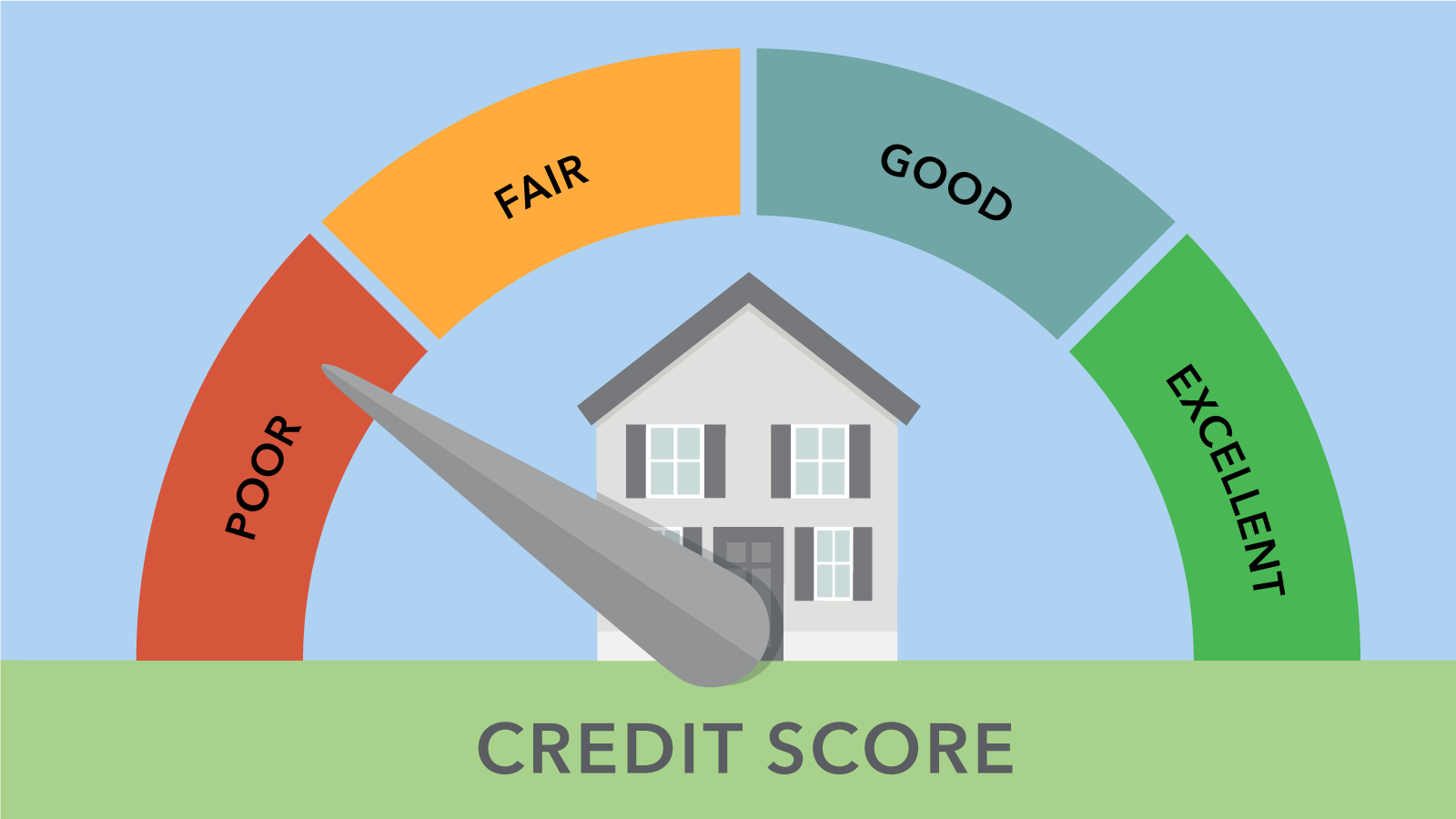

If you do have poor credit, apply for an fha loan; Late payments to companies that report monthly to credit bureaus (credit companies, car loans) report late payments, are reported at 30 days late, 60 and 90 i believe. The opposite is true, as well, when it comes to guarding your credit health.

Tips to repair your credit score 1. How to fix your credit in 5 steps 1. You can also file a report with the federal trade commission’s page identitytheft.gov.