Amazing Info About How To Sell Hedge Funds

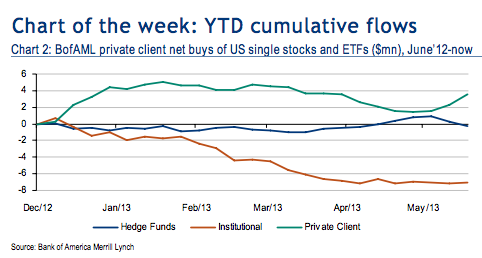

Hedge fund managers are still far behind their investing peers when it comes to marketing.

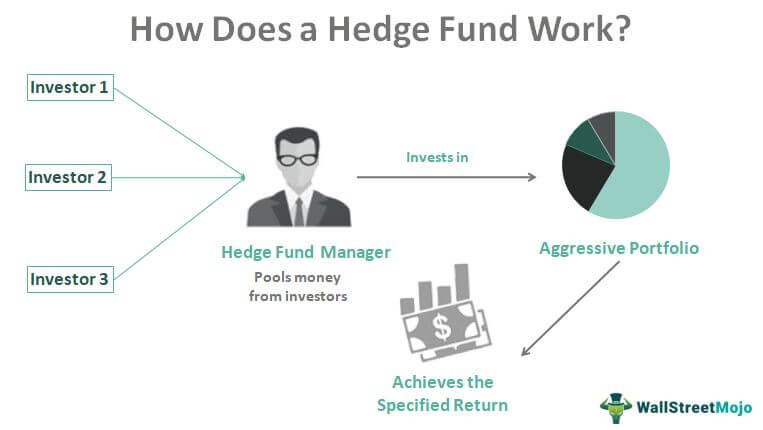

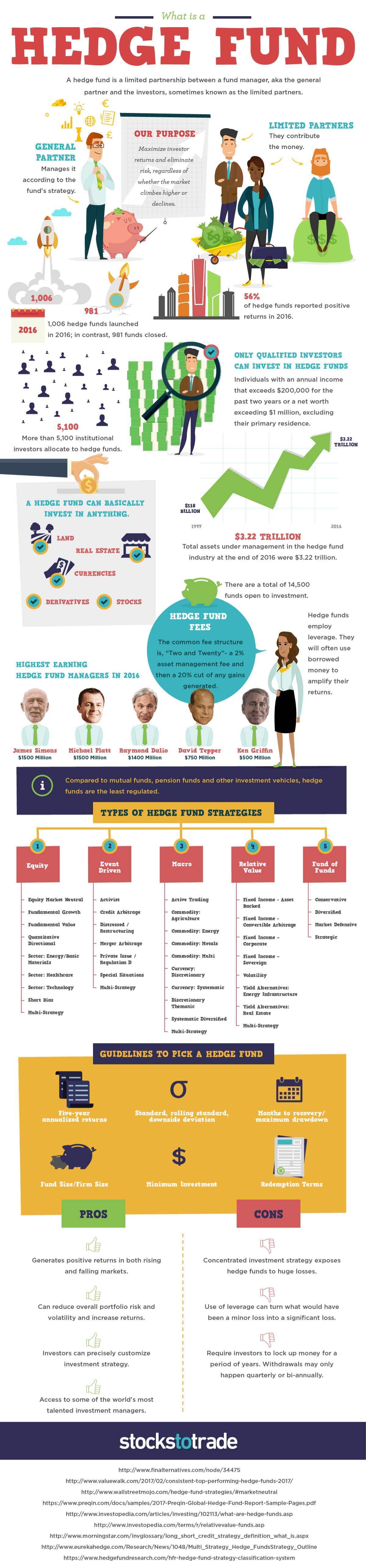

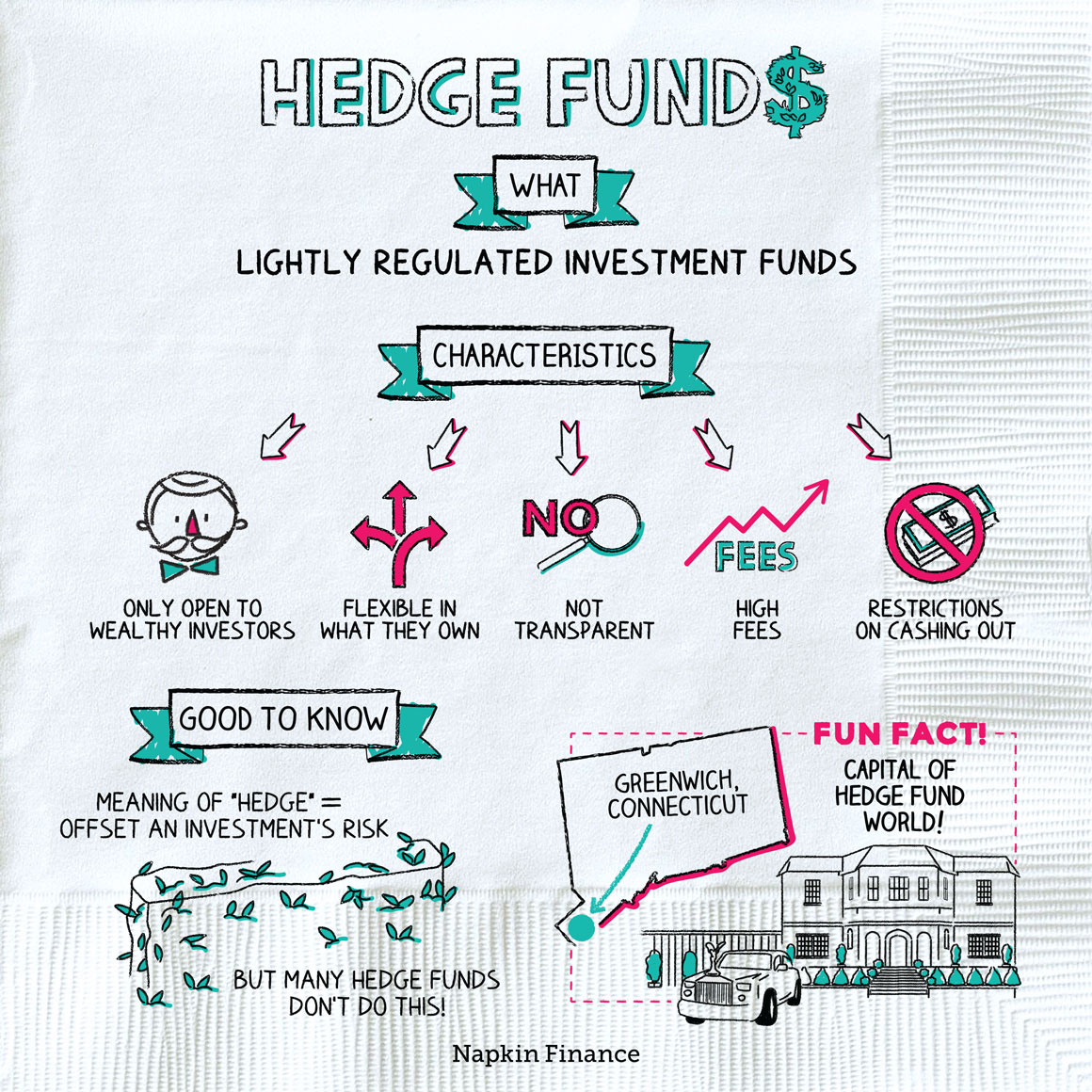

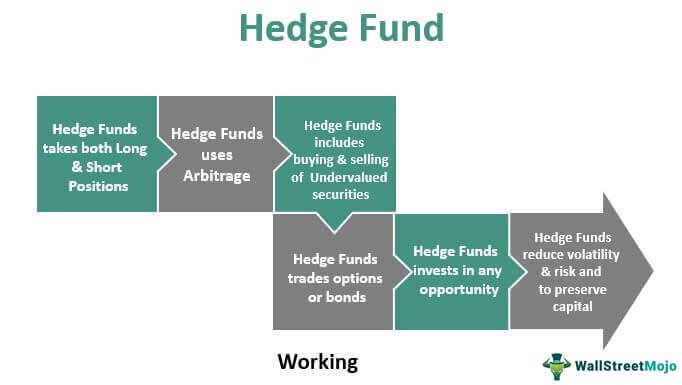

How to sell hedge funds. Like mutual funds, hedge funds pool investors’ money and invest the money in an effort to make a positive return. A performance fee could motivate a hedge fund. Glg’s approach is as basic as buy low, sell high in that they run profits and cut losses.

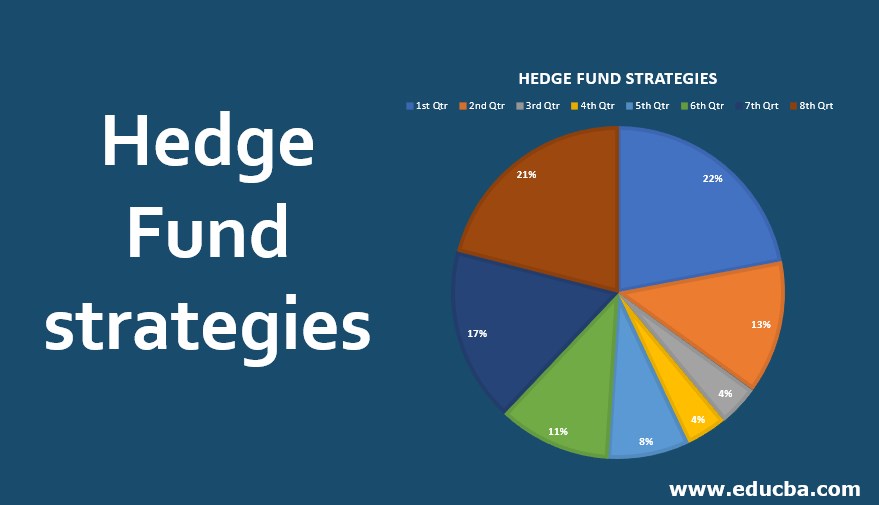

How to sell a hedge fund strategy. In the eyes of most investors, hedge funds are assumed to be slow, old financial vehicles of the past. How to sell data to hedge funds step 1:

Stocks insiders are buying but hedge funds are selling. Hedge funds are not all the same. It begins with understanding the operating system at the heart of the economy and the significant stocks that constitute short selling hedge funds and squeezing hedge funds.

Hedge funds are alternative investment funds. In this week's episode, we sit down with a former hedge fund director, matt bell, who gives us some really good tips for working with the big funds who are b. I'm going to show you exactly how to find hedge funds buying deals in your market today.

Tracking the trades made by wall street's biggest hedge funds has long been a source of ideas for regular traders and investors. Blue chip dividend stocks hedge funds are selling. But as the industry has fallen out of favor with.

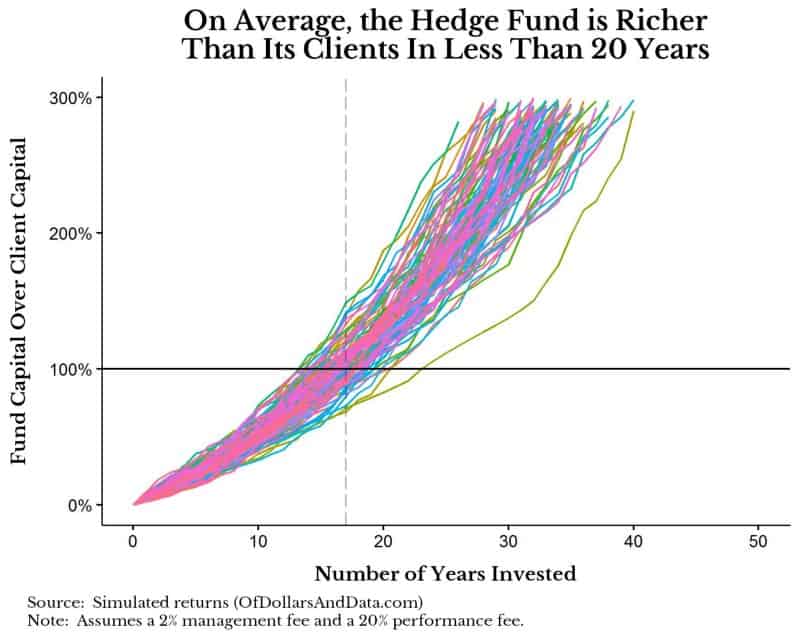

Second, to talk about an “average” hedge fund is misleading. This site makes it easy. As real estate investors we love wholesaling properties to hedge fun.

They may purchase securities on margin, or obtain loans and credit lines to fund even more purchases. Hedge funds typically have more flexible investment strategies than mutual. Stocks analysts like but hedge funds are selling.

So, if they only pick winning trades half the time, they still make money by making. Hedge funds typically use leverage to magnify their returns. They pool money from professional investors and invest it with the intent of making a profit, also known as realizing a return on.

/what-is-a-hedge-fund-357524_final_V2-fc839e05bb684e8eabc56e752f6e93d6.jpg)

:max_bytes(150000):strip_icc()/HedgeFunds3_2-0b396b0296d24f51a1b9a43423b68735.png)