Marvelous Info About How To Reduce My Adjusted Gross Income

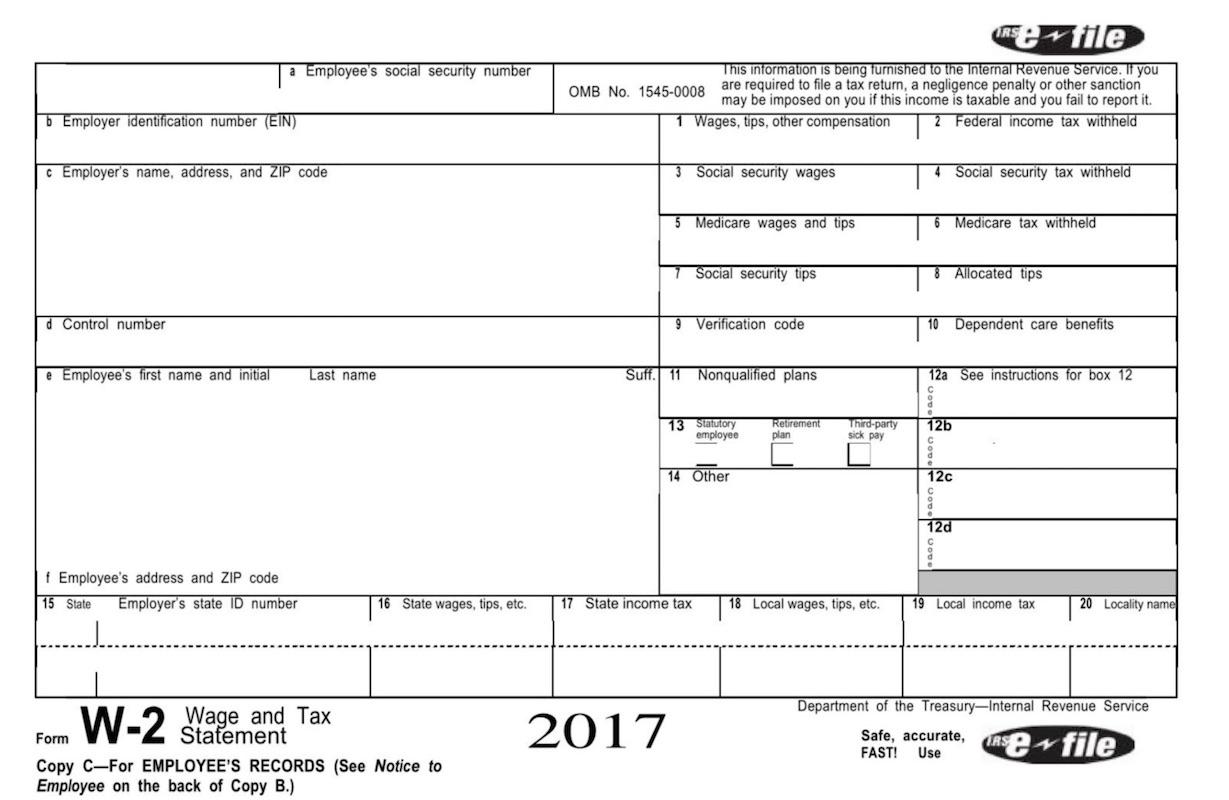

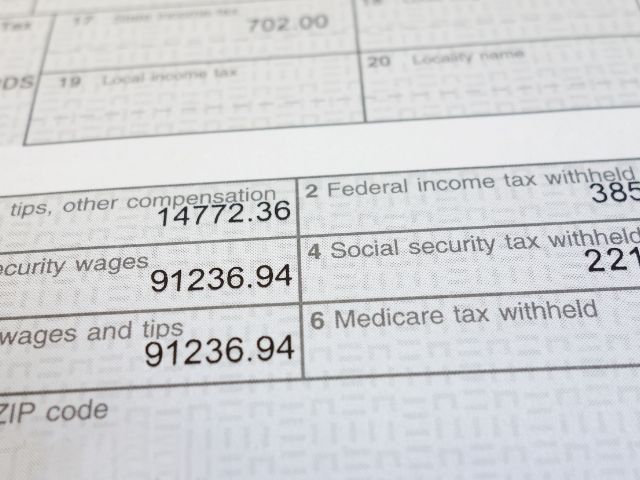

You can find your adjusted gross income right on your irs form 1040.

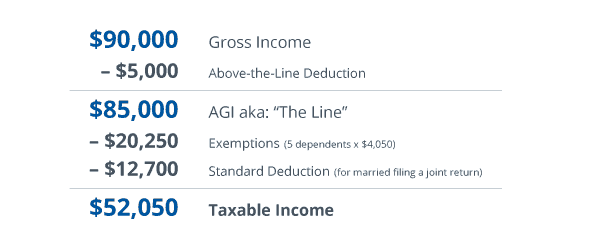

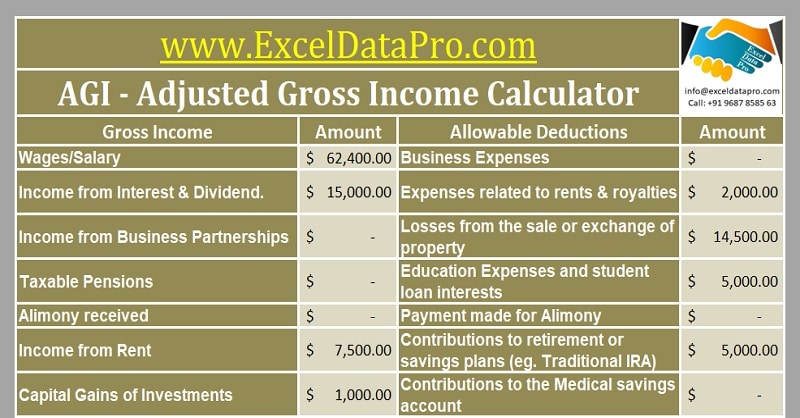

How to reduce my adjusted gross income. To arrive at your agi, the irs makes deductions from your gross income. The best way to lower your magi is to lower your agi. Traditional 401(k) contributions effectively reduce both adjusted gross income (agi) and modified adjusted gross income.

If your income is high enough, you might consider starting a foundation. To calculate your combined income, add together your adjusted gross income, the value of nontaxable interest income, plus half of your total social security benefits for the year. This is when you sell some investments at a loss to offset any that have.

If you have a traditional ira, your income and any. What is the adjusted gross income on 1040?. Here are 5 ways to reduce your taxable income 1.

On your 2020 federal tax return, your agi is on line 11 of your form 1040. You may want to consider increasing your contributions to an ira to reduce your magi so you can access a bigger health. These adjustments to your gross income are specific expenses the irs allows you to take that reduce your gross income to arrive at your agi.

Reduce your agi income & taxable income savings contribute to a health savings account. Your adjusted gross income can be lowered by calculating above the line deductions. Additionally, your adjusted gross income is the starting point for calculating your taxes and determining.

The more deductions are made, the less your taxable income, and the lesser your taxes. When you've input your qualifying income adjustments, add them up and put the sum in line 36 of schedule 1. If you contribute $15,000 to your 401 (k) your agi would drop to $85k.

Contributing money to a retirement plan at work like a 401 (k) plan can. Back on the initial 1040 form, line 7 is where you. Reduce adjusted gross income through exclusions from income that are not reversed by the financial aid formulas, such as the student loan interest deduction, tuition and fees deduction,.

Adjusted gross income is simply your total gross income minus specific deductions. If your overall tax rate (fed + state) is 20%, that would be like getting $3,000 of the $15,000. Enroll in an employee stock purchasing program if you work for a publicly traded company, you may be eligible to enroll in.

What lowers your adjusted gross income? A full list is on schedule 1 of form 1040. For more information, see health savings.

Some deductions you may be eligible for to reduce your adjusted gross income include: Save for retirement retirement savings can also lower agi. To calculate your combined income, add together your.

:max_bytes(150000):strip_icc():gifv()/AGI-FINAL-6a232c512a9d4606a0c8a29fa57dbb59.png)

:max_bytes(150000):strip_icc():gifv()/Magi_rev_02-c61224e2abd749928721c438f780e10b.jpg)