Best Of The Best Tips About How To Get Rid Of Loans

You and your cosigner’s credit.

How to get rid of loans. Americor® can help you get out of debt quicker. 15 tips for how to get rid of a car loan faster #1. A consolidation loan can simplify & lower your monthly payments.

Ad one low monthly payment. Find your best loan now! Check with your employer 5.

Ad receive personalized loan offers in moments. Find a lender & consolidate your debt today. Student loan settlement is possible, but it comes at a cost:

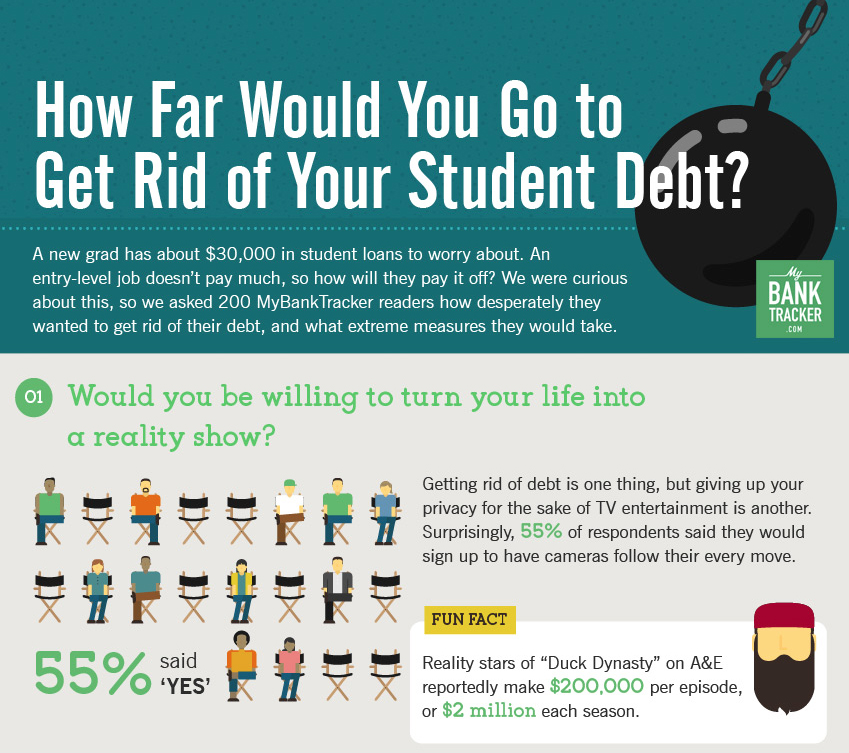

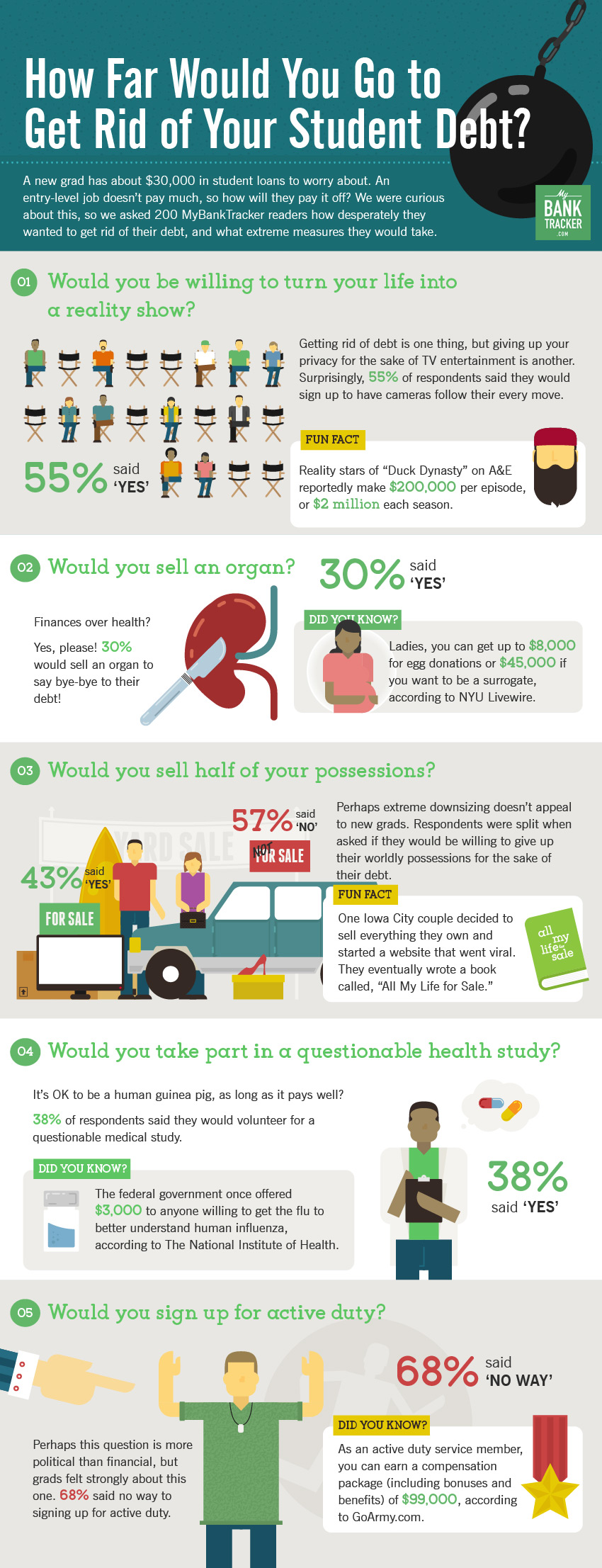

Get rid of student loan debt, simple trick, credit card balance transfer and bankruptcy under the quebec loan forgiveness program, you can get up to 15% of your. It is easy to apply. If you’re struggling with student loan debt, there are options available to help you get out of it.

As with federal student loans, you can immediately get rid of the debt — and the default on your credit report — by simply paying the full amount due. Get a free quote from a certified debt consultant! Find a lender & consolidate your debt today.

Student loan discharge isn’t the only way to get rid of your student loans. To do so, subtract the value of your car from the amount you still owe on your loan. A consolidation loan can simplify & lower your monthly payments.

You can reach out to your lender and negotiate a new payment plan. Ways to get rid of private student loans negotiate a settlement. This is an especially good option if you have good credit and payment histories.

If you’re having a problem stopping a lender from taking money out of your. Americor® can help you get out of debt quicker. If you have an fha loan term of more than 15 years, have been paying it for at least 5 years, and have an ltv ratio of 78% or less, pmi can be removed from the loan.

Ad financial relief with americor funding. For example, if you owe $20,000 on your loan and your car is only worth $15,000, you have. Ways to get rid of student loan debt 1.

If you revoke or cancel an automatic payment on a loan, you still owe the balance on that loan. Understand your loan terms #3. Apply for student loan forgiveness 4.

/GettyImages-1093086154-058134c8013c4dba80e8fbd13289c7ab.jpg)