Fabulous Tips About How To Become A Charitable Organization In Canada

Second, it must be established and operated for charitable purposes.

How to become a charitable organization in canada. After registration, registered charities (which. Determine whether you should apply to become a registered charity. Though charitable workers are exempted from esdc and do not need a lmia, applicants must have to produce documentation supporting the legitimacy of the offer of employment,.

They may be eligible to: Any party that meets the above registration criteria must register, including: Generally, your expenses will be divided into these.

A successful start usually requires solid planning and strong fund. Canadian federal income tax law. Apply to become a registered charity.

All money is donated to the organization’s cause or goal. Finally, the organization must devote its resources,. How do i start a foundation in canada?

Make an informed decision about becoming a registered charity. An organization must meet a number of general requirements to qualify for charitable registration under the income tax act. Determine whether you should apply to become.

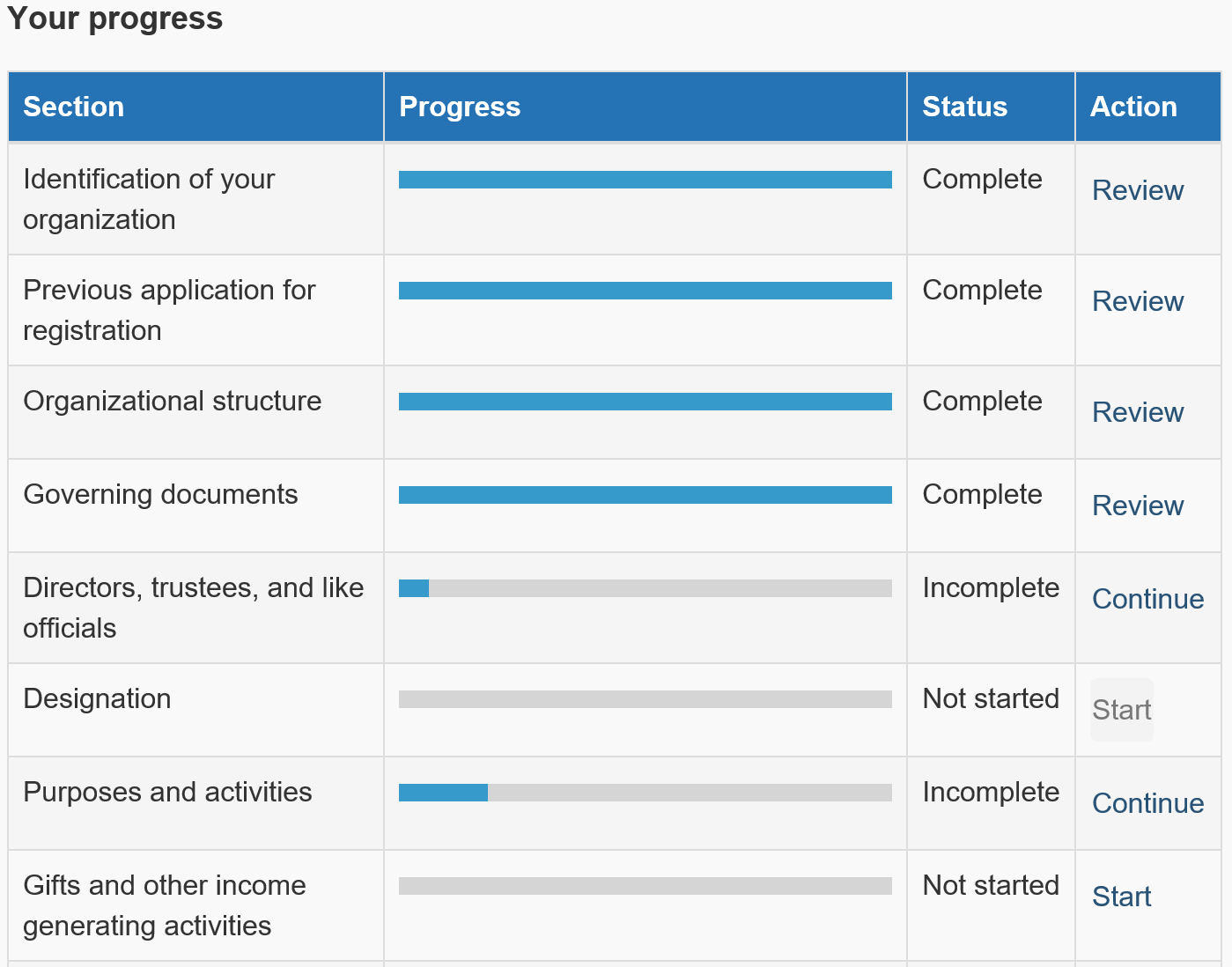

This workbook will help you become—and continue to be—a registered charity under the income tax act administered by the canada revenue agency (cra). To start a nonprofit organization in canada, you will need to register at the provincial and federal level. You can start a nonprofit organization with an investment of $750 at a bare minimum and it can go as high as $2000.

There are almost 86,000 canadian registered charities. Charitable organization registration organizations soliciting. Get a licence for a business that makes or manages solicitations on behalf of a charitable organization.

Societies do not earn any profits for its members. Register as a charitable organization: About 74,500 are “charitable organizations” that conduct their own activities whether by using volunteers, employees or.

Set up your organization before applying for registration.

:format(webp)/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/SP4VTYXFWJA3JIAXBXMTZP5UMY)